With all the pro words with it, buying a house feels similar to studying a different vocabulary. Today in the lessons into the a home talk: buying financial circumstances. When you get products (called write off items), you’re spending your way to a lower financial rate of interest. View it because pre-reduced notice. For every single part you get, it is possible to always knock 0.25% out-of the rate of interest.

Sound an excellent? Not very timely. To determine whether to pay money for affairs, you will have to balance new short-title price of the new situations up against the much time-identity offers you might rating off a diminished rate of interest.

Admiration your financial allowance

In the first place, usually do not purchase mortgage products if you cannot be able to. You’d be astonished exactly how many people pursue shortly after low interest rates at the expense of rescuing having emergencies and keeping so you’re able to a budget.

Facts are not totally free-for every part can cost you 1% of one’s mortgage well worth. When you are taking right out a $200,000 home loan, to buy a time will cost you $dos,000. A couple facts will cost you $cuatro,000. You get the idea. And this is near the top of settlement costs.

Do not get very fixated to the protecting a reduced you’ll be able to interest that you eliminate eyes of your budget and put debt fitness at risk.

Take into account the choice

Thus you might be comfortably affordable plus disaster financing try in good shape. Before applying free financing to purchasing mortgage situations, consider this to be matter: what might you are doing with this currency for those who failed to purchase activities?

- When you have highest-focus personal credit card debt, place more income towards paying down your own personal debt before you get points to decrease your home loan interest.

- Is the down payment 20% or maybe more of the home well worth? If not, you’ll want to buy individual mortgage insurance rates (PMI). In the event the in the place of to find affairs you might set more funds off, violation brand new 20% We, do it.

- If your 401(k) boasts employer coordinating and you are clearly perhaps not currently adding the most match-able amount, do not buy activities. Put you to more cash into your 401(k) or take advantage of the fresh free money from the newest fits.

- Without having medical health insurance, buy your self an insurance plan before you buy situations on the house loan. Wellness are money!

Do the much time evaluate

The money you pay at the start to purchase things usually straight down their month-to-month home loan repayments, nevertheless needs a little while of these offers in order to equal extent you paid off. This crack-even point relies on how much you pay on visit this page facts as well as how much you might cut monthly, plus what you would generate on that currency for people who spent it alternatively.

If you think there was a high probability you’ll be able to circulate till the break-also part, to invest in points probably actually most effective for you. That’s because new lengthened your stay in your residence at night break-even section, the greater number of big date you have got to reap the benefits of to get dismiss things at closing. If you think our home you may be about to buy can be your permanently household and you are if you don’t in the an effective economic figure (pick more than!) please pick situations.

We all know it’s difficult to understand how enough time you can easily sit in the a home, so think about the pursuing the concerns to help assess the chances one to you will end up about possessions for quite some time to come:

- How much cash might you including the household?

- Could it be the best size for your family? Could you be with much more students soon? As an empty nester?

- Just how likely could it be that you’ll go on to a unique urban area to find a different jobs and take proper care of an older cousin?

- Will our house need costly repairs and you may fix?

- ‘s the home for the an on-chance region having floods or flames?

To find mortgage things to the a property you consider since your beginning household isn’t really usually the best entry to your own difficult-acquired currency. When you have a small dollars remaining every month and your loan does not include prepayment charge, you can always submit some extra currency together with your mortgage fee and you can signify you want the cash to visit to your settling the dominating.

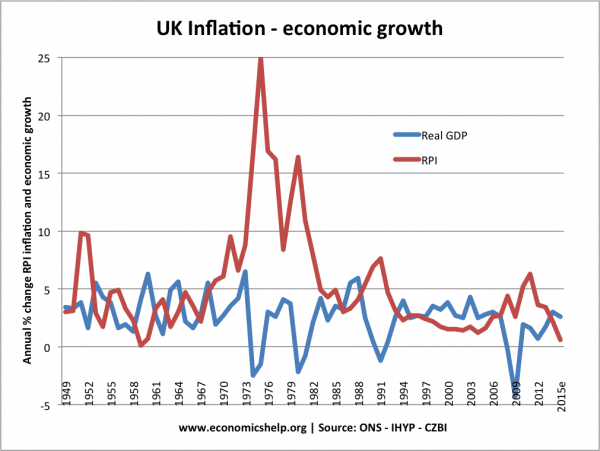

A unique much time-identity issue is interest fluctuation. What if you purchase activities right after which a couple months after interest levels slip across-the-board? Unexpectedly, loan providers have to give mortgage loans that have interest levels beneath the one you paid back factors to secure. When deciding to take advantageous asset of the individuals low interest you’ve got to go through a costly refinance and forfeit the loan you covered.

Shop around

Perhaps you have shopped around for other mortgage brokers? Will you be sure that the interest rate you’re interested in trying out from the to buy financial facts ‘s the low price you can aquire? Only consider to invest in mortgage points when your treatment for each other this type of issues was yes. As to the reasons? Once the one bank can offer your a minimal price you to yet another financial just has the benefit of after you purchase factors.

For those who have an imperfect credit score but they are today for the best monetary roadway, you can also believe that the mortgage rates of interest on the market was unfairly highest. If so, to invest in home loan facts is generally the merely way to reasonable attract pricing.

Think about your long-term arrangements and you can weighing the choice to buy products up against almost every other an approach to purchase your money. For individuals who proceed with the four rules above, you’ll generate an informed decision you could potentially feel good about. Only if choosing a property had been this easy!